Payroll Scrutiny Hits a New High in Australia

Posted by Alloc8, Mon, Aug 24, 2020

During the last financial year, we have seen countless organisations hit with substantial fines for underpaying their employees. These fines have not been limited to large corporations. Small businesses, construction companies, aged care facilities, and field services were all met with hefty fines in the last 12 months for not complying with payroll standards.

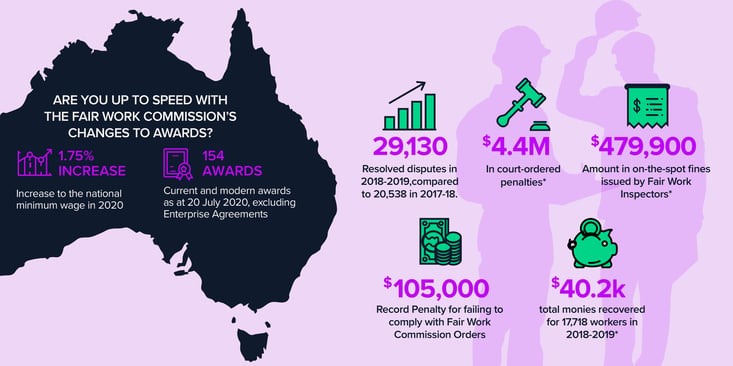

In fact in 2018-2019, there were:

- 29,130 completed disputes

- Fair Work on-the-spot fines of $479,900

- $4,400,772 in court-ordered penalties

- $40,204,976 in total monies recovered for 17,718 workers

Source : Fair Work Ombudsman and Registered Organisations Commission Entity Annual Report 2018–19

Moreover, some businesses continue to owe millions to their staff; Merivale facing court over an alleged wage theft of around $126 million, Coles admitted to underpaying employees by $20 million, and Qantas were accused of underpaying workers up to $10 million, to name just a few examples. Here is a list of Recent Employer Prosecutions by Workforce Guardian.

In addition to this crackdown on wage disparity, the Fair Work Commission review all modern awards every 4 years, with the decisions from the most recent 4 year review being implemented throughout 2020. This includes a 1.75% increase to the national minimum wage from July 2020 or February 2021 depending on the award. There were also changes announced in July that impact the following awards:

- Social and Community Services Award

- Aged Care Award

- Building and Construction Award

- Joinery Award

- Mobile Crane Award

- Miscellaneous Award

Changes include updates to weekend casual rates, public holiday rates, distant work arrangements, annual leave loading, overtime, and more.

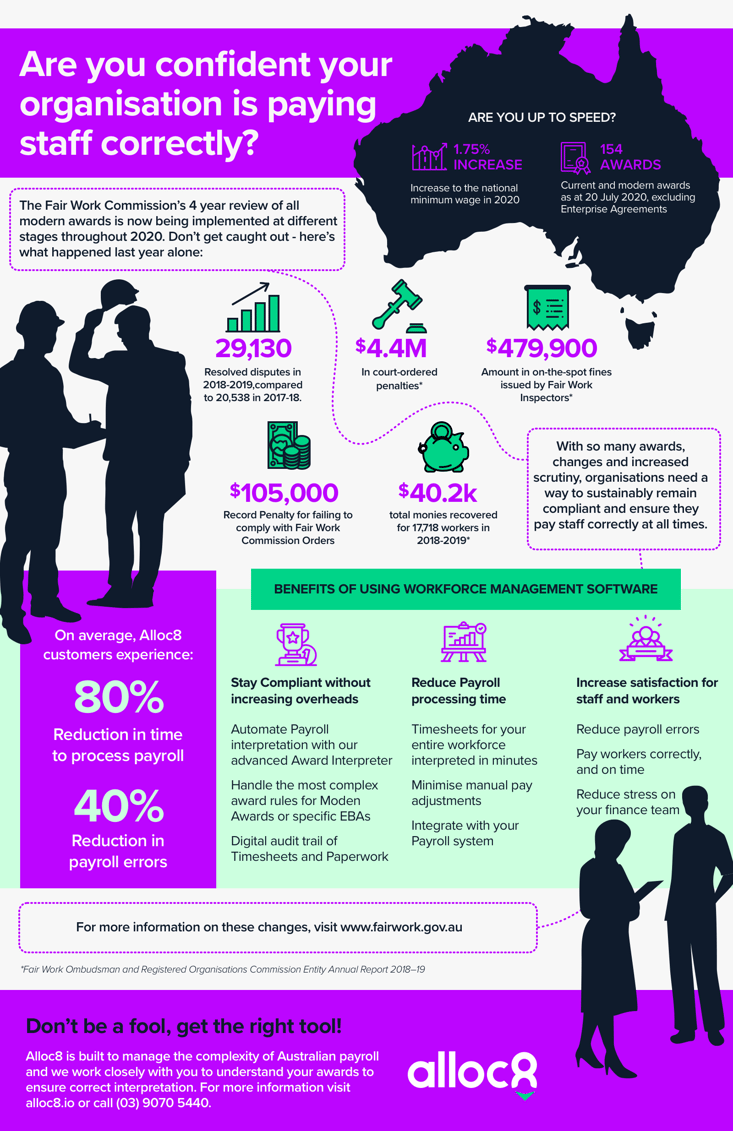

With these changes to awards, and with the increasing focus on wage disparity, it is crucial that your business is committed to being payroll compliant. Not only from a legislative point of view, and to avoid the hefty fines being issued, but to also ensure you’re doing the right thing by your employees. Even small issues or discrepancies can build up to large sums over time.

In addition to maintaining the correct award, organisations have also noted challenges of missing or lost timesheets, lack of compliance and an audit trail of payroll and timesheeting, excessive administration time involved in interpreting timesheets, and a communication breakdown between workers and the office.

Some of the ways employers can maintain best practice is by regularly checking award rates, ensuring timesheets are correctly interpreted, ensuring leave entitlements are set up correctly, and ensuring hours tracked are accurate. This can either be done manually by a team of administrators or alternatively by using a sophisticated rostering and award interpretation platform, such as Alloc8.

Alloc8 has the following features to help your business achieve payroll compliance:

- Payroll interpretation entirely automated with Alloc8’s advanced custom Award Interpreter

- Complex Award Interpretation

- Integrated timesheets with seamless interpretation

- Audit trail of timesheets and payroll

- Payroll integration

Alloc8 has been able to help some of our clients reduce payroll errors by 40%, and reduce the payroll processing time by 80%.

If you would like to find out more about how Alloc8 could help your business, get in touch with our team.

There’s no better time than now to get on top of your payroll and have confidence that your organisation is correctly paying your staff.

For the full list of changes to awards, you can visit the Fair Work Commission website.

Topics: news, industry news